The process of verifying that commodities adhere to import-export laws prior to entering or leaving a nation is known as customs clearance in international trade. Logistics that are halted at the border because of problems, missing paperwork, or approval inspections are considered customs clearance delay challenges. This delay can halt logistics operations, raise expenses, and compromise a company’s trustworthiness. Delays with the Delivery Duty Paid service (DDP shipping) or freight forwarding service might result in major problems because the facilitation of global trade depends on efficiency. Support for customs clearance delay is essential for businesses providing worldwide supply chain services in order to maintain trouble-free goods movement.

What is Custom Delay

A clearance delay happens when customs holds your package or shipment. If you ship internationally or bring products across borders, you definitely want to avoid this situation. With today’s fast and often free shipping, long import delays can hurt your business. When customs holds up your shipment, your customer won’t get their product on time.

How to Avoid Customs Clearance Delays

High Risk Clearance Delay Terms

Impact of Customs Delays on Businesses

The lack of importer or exporter for record services often makes it difficult for companies to meet the approval criteria. Those who fail to comply may face penalties and could face confiscation for their shipments.’ Ensuring robust import-export assistance, the use of appropriate Incoterms and product categorization according to HS code or HTS regulations are key factors in mitigating these risks. Those that focus on customs clearance delay support not only lessen these risks but also elevate their position in the global export arena.

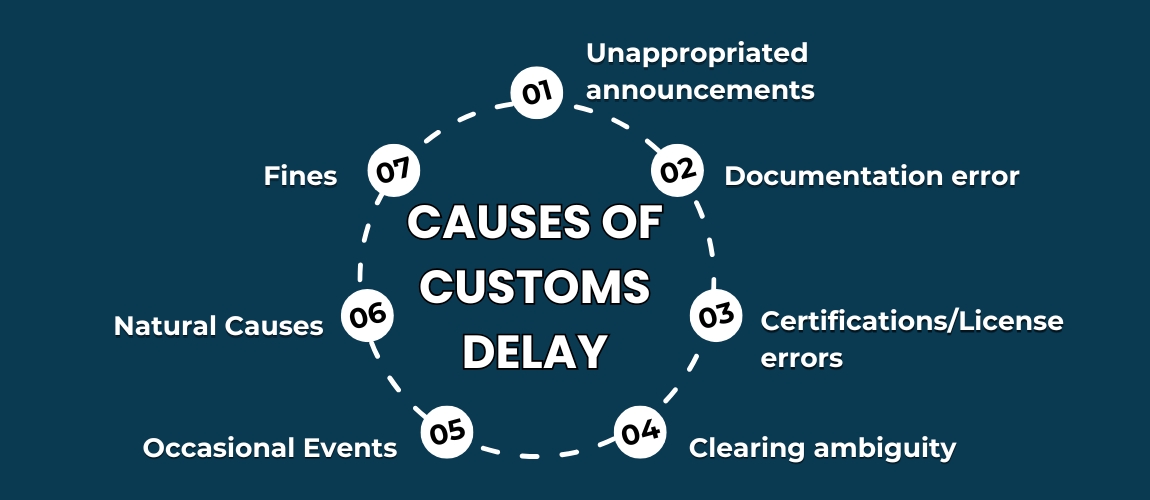

What Are The causes of Customs Delay?

1. Unappropriated announcements

An incorrect value or description of goods may result in an incorrect Customs Declaration, leading to an inaccurate classification and potentially causing the wrong licence (or lack of a licence). The classification number used will automatically select goods, resulting in the shipment being held and placed under query by HMRC. An EORI number is not provided for import and export, which can result in an incorrect Customs Declaration. If this is absent, the complete Custom’s entry cannot be completed. Typically, incorrect Customs Declaration is made due to inadequate knowledge during the completion of commercial documentation for shipments, such as from a third-party country to the UK or vice versa. Ensure that you have all the necessary information for a Customs Declaration.

2. Documentation error

Clearance cannot begin without the clearing agent’s knowledge of the Customs Declaration. Consequently, the customs clearance delay as the device is stored in a transit shed at Heathrow while you wait for it to be validated by your US office. The delay in clearance may result in additional costs for storage and the need for a special vehicle to transport the machine to your location. At present, your client decides to leave once they are unable to wait in the UK. This minor detail has led to a missed sales opportunity, wasted time and effort, and additional transport costs due to incorrect documentation. Both parties are now experiencing this.

3. Certifications/License errors

In case the freight forwarder hasn’t checked if an Export License is required or has the necessary information, the goods may still be transported, even though they could. Therefore, the goods may be kept at the UK freight forwarder’s warehouse for a few weeks while they undergo examining. You are unable to charge the client and will need to justify the delay, which could indicate your incompetence. Your export declaration cannot be prepared or submitted without the proper Export License from either your freight forwarder or the Customs clearing agent.

4. Clearing ambiguity

HMRC is often mistook for cause of delay. The electronic clearing of Customs usually occurs within minutes for 99% of all entries.

5. Occasional Events

Have you considered the significance of Eid, Christmas, but are there any potential concerns regarding the New Year? January and February bring about dramatic changes in shipping schedules. This period is significant. Moreover, Black Friday in November results in an enormous amount of pressure on couriers and delivery companies. The seasonal customs clearance delay are more likely to impact infrastructure, logistics capacity, and networks, rather than being a Customs issue.

6 Natural Causes

Manage your shipments in accordance with seasonal weather conditions. Additionally, pay attention to political whispers as they could lead to unrest and the worst-case scenario of port shutdowns.

7. Fines

You don’t want your shipment to be seized, or fined. Depending on the offense committed and your level of business compliance, HMRC may levy “civil penalties” on importers, which can vary significantly. Export Licence evasion is an offense that can lead to imprisonment. If you make a serious mistake in import or export, criminal investigations may be initiated.

How to Avoid Customs Clearance Delay

Technology benefits

Software designed for international trade provides proper documentation submission, to avoid customs delay and accurate tariff calculations and complete compliance checks prior to shipment. Your team can identify document inconsistencies before the outbound shipments process by using customs management software. Systems-based software enhances the classification process and simplifies international transactions by incorporating automatic procedures.

Keep up with ongoing training on trade compliance

Training your team in customs regulations is essential for avoid customs delay as the rules are intricate and display differences among nations. Each member of the customs team receive a comprehensive training program that covers both current regulations and the documentation, record-keeping, and performance requirements. Regular training sessions involving your staff will identify potential issues, which will help prevent significant problems and ensure efficient customs clearance.

Use an experienced customs broker to meet your solution requirements.

The benefits of working with experienced customs brokers are self-evident, especially in areas like aviation and healthcare to avoid customs delay that necessitate precise licenses or accreditations. This helps avoid errors and delays by helping brokers with tariff classifications and duty calculations.

Planned uncertainty

A backup plan is necessary to avoid customs delay such as document errors and tariff misunderstandings. What steps should you take? You can use your backup strategy to handle unexpected delays more effectively and avoid expensive errors.

Conclusion

Having knowledge of international import and export requirements is essential when dealing with shipping and Customs. Come to A1Pakcargo to build a best ongoing cargo process with us, to ensure smooth deliveries, and tips customs clearance process as we are always here to provide you guidance, support and cheap Pakistan cargo shipment.

07424380227

07424380227