It can be a significant financial burden to pay for multiple international shipping options when developing e-commerce websites that sell internationally. Especially when you have to satisfy consumer needs for items that are already fast and free of charge from sellers on eBay and Amazon.

Choose the Right Shipping Method

When speed is not a consideration, air shipping becomes advisable

If a company deals with expensive, time-sensitive items like medical supplies, electronics and fashion collections, or food products that have spoiled packaging, air freight is advisable. Air travel may be more expensive for passengers than sea or land transportation, but the time savings are worth it, especially if delays result in missing market opportunities or spoiling stock stocks. Additionally,

Air shipping companies have remarkably precise schedules, thanks to the strict guidelines enforced by airlines. The handling of airborne goods is less densely populated than oceanic goods, which limits their potential for damage or theft. Despite the benefits, there are strict limitations on the quantity, weight, and type of cargo that can be transported onboard.

The carbon footprint of air transportation is not well-defined as it generates more emissions per kilogram of goods transported. Some companies could resort to air shipping as a last resort due to the increasing demand for environmentally friendly products. This is why.

Sea shipping is the primary means of international trade

Sea freight has been a crucial component of global trade for the past several decades, handling roughly 90 percent of all trade goods.’ The most economical method of transportation for large, heavy or bulky goods that are not in high demand at the destination.

The majority of companies that transport furniture, industrial machinery, raw materials, refrigerated goods, and perishable products opt for sea transportation to balance low freight rates with good delivery schedules. In contrast to sea freight, air shipping has numerous limitations on the size and classification of its cargo.

A Link Between Freight and Land Shipping

Trucks are typically used to transport goods by air or ocean. What is the end result? Shipments. Road/rail delivery is the simplest method for local/regional businesses to move materials to warehouses, distribution centers and stores.

Delivery flexibility is provided by trucking, particularly when it comes to small to mid-sized loads that need to be delivered in a specific timeframe. However, rail transportation can be very useful for large scale transportation where covering long distances in a country with an advanced railway system is necessary.’

There is also a case for hybrid solutions. Most companies opt for a mix of sea and air travel to achieve cost-effectiveness and swiftness. The. An instance of this is that they could use sea transport to ship most of their stocks, but air transport would be necessary to restock quickly when sales energy increases.

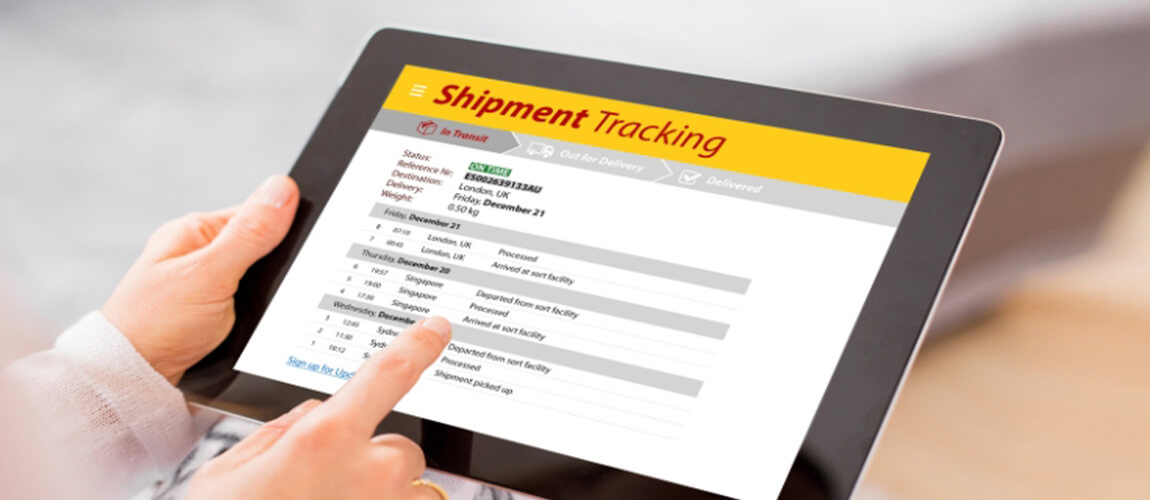

Use Proper Packaging and Labeling

A vast array of information is included in single package labels, which are used to achieve efficiency and satisfaction from customers. E-commerce businesses and those engaged in individual shipments, may need to satisfy certain requirements:

- Shipping company specifics, with a tracking number for ongoing traceability. Additionally,

- A clear explanation of what is included in the package for transparency.

- Weighing and the size, to help with logistics.

- Specific instructions for handling delicate objects.

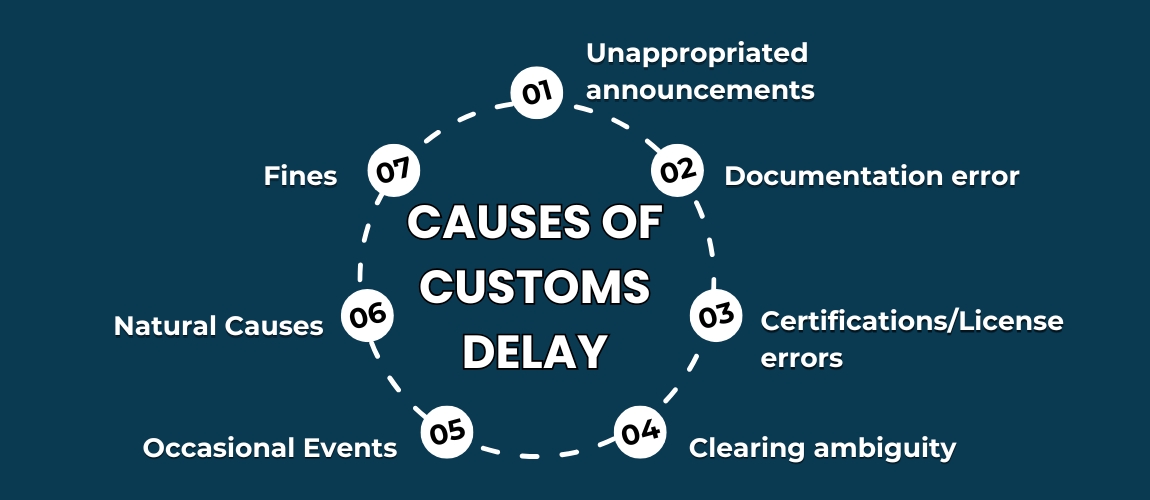

Understand Customs Rules and Regulations

The World Trade Organization was founded to establish three pillars of Customs compliance, which later evolved into international trade facilitation agreements. The WCO is responsible for implementing the same agreements into practical operations and translating them into national Custom regulations and policies with support from the WTO.

While the procedures may differ across nations, it is beneficial to be familiar with their origins, supporting agreements, and the reasons for implementing those agreements at borders. All Customs Authorities follow the same basic principles and sing from the exact same hymn sheet.

Control and Optimize Shipping Costs

To increase the density of packages, eliminate dead space.

Ensure that your shipment can be stacked, eliminating the need for payment for the entire area above it.

Non-stackable shipments are subject to higher charges by carriers of all modes of transport since it cannot be combined with other cargo.

Ensure that the packing material matches industry standards.

Consider Cargo Insurance

Choosing a freight forwarder that offers insurance can make the insurance process incredibly simple. Dimerco and other major, reputable forwarders offer All Risk Cargo Insurance that can handle many aspects of the deal. It’s a quick process to secure your coverage by providing standardized documents. Why? It is important to note that the right forwarder can expedite and simplify the process of filing a claim. Your forwarder receives the information about the loss or damage once you provide it. Their responsibility is to handle all correspondence with the insurer and settle the claim on your behalf.

Avoid Common International Shipping Mistakes

Items Being Shipped

Individuals who ship goods such as fuel, chemicals and other food items will have to pay higher rates for cargo insurance compared to those that transport plastic objects or toys.

Marine cargo insurance is influenced heavily by the type of goods being transported.

Risky products, valuable items that are perishable or fall victim to theft and damage, as well as those with high value goods, tend to have higher cargo insurance costs.

The insurance costs for transporting certain goods can be high, such as:

Hazardous substances such as gasoline, flammable gas, or explosive. Conversely.

- Large machinery

- Valuable electronics

- Perishable items

- Luxury items

It’s crucial to have insurance for these items if they go missing. Why?

Loss History

An importer’s cargo insurance premium is impacted by previous losses incurred during shipping and claims that have been filed.

Insurance applications may ask questions about the level of risk a business poses to insurance policies, such as prior loss.

Risk Management Strategy

Your insurance company will charge you more for coverage if your business is at greater risk.

The practice of shipping precautions can lower the likelihood of a claim, thus protecting against potential deductible payments and premium hikes.

Insurers may offer a reduced premium to shippers who take concrete steps towards risk reduction.

Often, shippers find that risk management training and protocol work contribute positively to the reduction of marine cargo insurance rates. Risorgy can be addressed by implementing programs to prevent theft, disaster preparedness, human resources training, workplace safety measures, and other strategies.

Shipping Route

The rates may be heightened by taking roads through mountainous, icy, isolated, or hazardous regions.

Premiums may be heightened due to political instability in the country of origin or the final destination.

Conclusion

To accurately describe the risks of your business, an underwriter will need all the necessary information.

It is recommended that importers use an agency that asks numerous questions to gain a comprehensive understanding of their business. Provide more details and importers will receive a better quote as insurers can evaluate risk with greater accuracy. Why is this?

07424380227

07424380227